随着区块链技术和加密货币的迅猛发展,以太坊作为第二大加密货币,其应用场景和投资机会受到了越来越多投资者的关注。以太坊不仅仅是一种数字货币,它的平台允许开发者创建智能合约和去中心化应用(DApps)。这意味着,如果您能够掌握相关知识并采取适当的措施,完全可以从以太坊中获得可观的收益,而申请和使用以太坊钱包是其中的一个重要步骤。

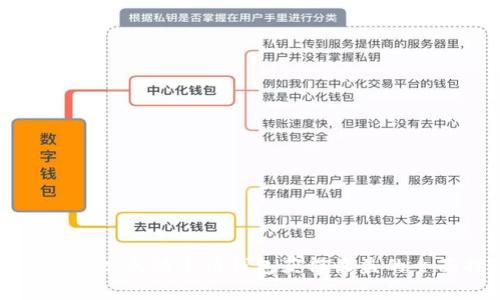

以太坊钱包是一种存储、发送和接收以太坊(ETH)及其他基于以太坊平台的代币的工具。与传统银行账户不同,以太坊钱包通过私钥和公钥进行运作,确保用户对其数字资产的完全控制。这些钱包可分为热钱包和冷钱包两种类型:

热钱包:在线钱包,方便快速交易,但因连接互联网而面临一定的安全风险。

冷钱包:离线存储设备,如硬件钱包,安全性较高,适合长期持有投资,但交易时需要连接到互联网。

通过以太坊钱包获取收益的方法主要包括:

申请以太坊钱包并获得收益的步骤如下:

在以太坊钱包中,私钥和公钥是两个密切相关但用途不同的概念。公钥是钱包的地址,可以与其他用户共享,用于接收以太坊;而私钥则是存储在用户终端的机密信息,任何拥有私钥的人都可以控制钱包中的资金。保护私钥的安全至关重要,一旦泄露,资金将面临被盗风险。因此,用户必须妥善保存并采用多重身份验证等安全措施。

选择安全的以太坊钱包是确保投资安全的第一步。首先,用户需考虑钱包的类型和技术背景,热钱包虽然方便,但因在线连接而存在被黑客攻击的风险;冷钱包虽然操作较为不便,但能有效保护资产。还需检查钱包的开发团队背景和第三方安全审计记录。此外,用户应重点关注钱包是否采用加密技术、双重认证等安全措施,确保其资产安全。

The staking process in Ethereum 2.0 involves several steps. Firstly, users must have at least 32 ETH to become a validator. The process entails depositing this ETH into a designated smart contract. Once the deposit is made, the user’s account is locked for a certain period, during which they participate in validating transactions, ensuring network security, and confirming blocks. In return, validators receive rewards in the form of ETH for their contributions to the network. The income from staking depends on the number of validators and the total amount of ETH staked. Users who are not willing to stake the full 32 ETH can also use staking pools, where they can stake smaller amounts and still earn a portion of the rewards.

Investing in Ethereum and operating a wallet carries inherent risks. Price volatility is one of the most significant factors, as the value of ETH can fluctuate dramatically in short periods. Additionally, there is always the risk of cyberattacks, especially with hot wallets. If your device is compromised or your private keys are stolen, your assets may be lost forever. Furthermore, the regulatory environment surrounding cryptocurrencies continues to evolve; potential regulations could impact the legality and usability of Ethereum wallets. Lastly, the technology itself can be complex for beginners, making it essential to conduct thorough research and seek professional guidance when needed.

If you lose access to your Ethereum wallet, recovery depends on how you initially set up the wallet. Most wallets provide users with a recovery phrase or seed phrase during the registration process. If you have saved this phrase securely, you can use it to recover your wallet on any compatible platform. However, if you do not have a backup of your recovery phrase or have lost your private keys, unfortunately, the funds in that wallet will be permanently inaccessible. This highlights the importance of securely backing up your recovery information and using multi-signature wallets for added security.

To make informed decisions on Ethereum investments, it is vital to keep an eye on several key trends. Firstly, the transition to Ethereum 2.0 and its impact on transaction speeds and fees can significantly affect market behavior. Monitoring changes in DeFi protocols and their popularity is also crucial, as they can drive demand for ETH. Additionally, regulatory developments can impact market sentiment and use cases for Ethereum. Finally, keep an eye on major technological advancements, such as layer-2 solutions that can improve scalability, both of which can influence Ethereum’s growth trajectory.

通过以太坊申请钱包获取收益是一项长期而复杂的投资策略。投资者必须对区块链技术、货币市场和安全措施有深入的了解。同时,不同的收益方式如质押和参与DeFi也为投资者提供了多样化的选择。然而,必须始终保持谨慎,认识到投资所带来的风险和挑战。随着以太坊生态系统的发展,掌握必要的知识和技能将能使您在这个充满机会的市场中占据一席之地。

leave a reply